In today’s fast-paced, high-stakes startup ecosystem, tech entrepreneurs and business owners face a multitude of legal risks. As technology startups scale rapidly, decisions made by directors and officers (D&O) come under increasing scrutiny from investors, regulators, and employees. Without the right protection, a single lawsuit could jeopardize the personal assets of leadership and derail the company’s growth. This is where D&O Insurance plays a crucial role.

D&O insurance provides essential coverage for directors and officers of technology startups, shielding them from legal claims arising from their decisions and actions. From breach of fiduciary duty and financial mismanagement to employment-related lawsuits, these claims can be financially devastating for a startup that is unprepared.

In this article, we’ll dive deep into why technology startups need D&O insurance, explore real-world claims scenarios, and outline the key benefits this coverage provides for fast-growing tech companies. Whether you’re a CEO, founder, or board member, understanding how D&O insurance can protect your startup’s future is critical in today’s complex business landscape.

Why Startups are Vulnerable to Legal Risks

Technology startups, by their very nature, operate in high-risk, high-reward environments. As these companies scale rapidly and navigate complex financial and regulatory landscapes, they expose their directors and officers to a variety of legal challenges. Without D&O insurance, the personal assets of key decision-makers can be on the line, making it critical for any tech startup that wants to grow sustainably.

One of the main reasons startups are vulnerable is that decision-making is often fast-paced, with limited oversight. Startups are constantly pivoting, trying new strategies, and making quick decisions to stay ahead in a competitive market. In this environment, mistakes happen—and when they do, directors and officers can be held personally liable.

Common Legal Risks for Startups

- Breach of fiduciary duty occurs when directors or officers fail to act in the best interest of the company and its shareholders. For example, if an officer makes a decision that benefits their personal interests over the company’s, they could face lawsuits from shareholders or investors.

- Financial mismanagement often leads to legal claims from creditors, investors, or stakeholders, particularly if it results in insolvency. A well-known example is a tech company struggling with funding that faced lawsuits for failing to secure capital on time, resulting in a default on loans.

- Regulatory compliance issues can arise if startups inadvertently violate data protection laws or fail to secure proper cyber protections.

Unique Insight: The Role of Rapid Scaling

One overlooked risk is the pressure to scale quickly. While growth is the ultimate goal for many startups, the push to expand can lead to hasty decisions, such as hiring unqualified personnel or entering into poorly vetted contracts. These actions, driven by the need for rapid expansion, increase the chances of legal missteps.

Incorporating D&O insurance early in a startup’s life cycle is not just about protecting against known risks but also preparing for unforeseen challenges that come with scaling.

Real-World D&O Claim Scenarios for Startups

Startups face many legal claims that can be financially devastating without D&O insurance. Below are common scenarios where D&O insurance is essential for tech startups:

Intellectual Property Theft and Infringement

A frequent issue in tech startups is intellectual property (IP) theft. Consider a vice president leaving their firm to start their own company, taking proprietary software with them. The former employer might sue for trademark infringement and unfair competition. Without D&O insurance, the personal assets of those involved could be at risk.

Misrepresentation of Financial Health

Misrepresentation claims often arise when companies provide false financial statements to secure funding or new business contracts. For example, a startup may claim to have more financial resources than they actually do, which can lead to investor lawsuits. In one real-world case, a tech startup secured a large contract by inflating its financial capabilities, only to fail in meeting the contract requirements, resulting in a lawsuit.

Employment Practices Violations

Employment-related lawsuits are common in rapidly growing companies. Claims related to wrongful termination, discrimination, or harassment can expose directors and officers to personal liability. For instance, if an employee sues for gender discrimination following a wrongful termination, the company and its leadership could face costly legal battles without D&O coverage.

How D&O Insurance Protects Startups

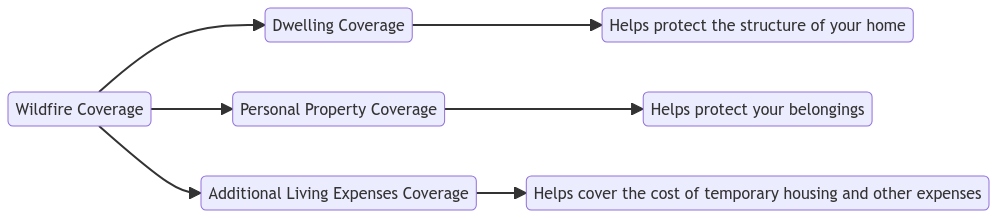

D&O insurance offers three levels of protection, each addressing different aspects of potential legal claims:

Side A Coverage

This part of the policy protects individual directors and officers when the company is unable to indemnify them. It ensures that if a director or officer is personally sued for wrongful acts committed while performing their duties, their personal assets remain protected.

Side B Coverage

Side B reimburses the company for indemnification payments made to its directors and officers. If the company covers the legal fees and settlements of its leadership, this coverage helps the business recover those costs.

Side C Coverage

Also known as entity coverage, Side C protects the company itself from claims, particularly securities-related lawsuits. It covers any claims brought against the company and its leaders for misrepresentation or financial wrongdoing during fundraising or other public disclosures.

Benefits of D&O Insurance for Technology Startups

Attracting Investors

Investors, especially venture capitalists, often require startups to carry D&O insurance to mitigate their risk. This type of coverage assures investors that both the company and its leadership are protected from legal claims, reducing the financial impact of potential lawsuits.

Talent Acquisition and Retention

High-profile executives and board members are more likely to join a startup if they know their personal assets are protected. D&O insurance is an essential tool for attracting top talent.

Surviving High-Cost Legal Threats

Without D&O insurance, startups risk losing valuable resources to defend against lawsuits. With the right coverage, companies can focus on growth while ensuring they are protected from costly litigation.

Key Milestones for Startups to Secure D&O Insurance

Startups should secure D&O insurance at several critical points, including:

- Raising venture capital: Investors often make D&O insurance a requirement during funding rounds.

- Hiring key executives: As the company grows, more decisions are made at the leadership level, increasing the risk of lawsuits.

- Preparing for an IPO: Public companies face increased scrutiny, and D&O insurance becomes vital for protecting against securities-related claims.

Quick Takeaways

- D&O insurance is essential for tech startups to protect directors and officers from personal liability in legal claims related to their decisions.

- Common claims include breach of fiduciary duty, employment practices violations, and financial mismanagement.

- Side A, B, and C coverages provide comprehensive protection for both leadership and the company itself.

- Investors and top talent are more likely to engage with a startup that has D&O insurance.

- Securing D&O coverage early helps mitigate future risks and supports growth as startups scale.

Conclusion

In today’s volatile business landscape, technology startups face unique legal risks that can threaten the personal assets of their directors and officers. By securing D&O insurance, tech startups can safeguard their leadership and ensure long-term stability as they grow. Whether it’s attracting investors, retaining key executives, or surviving costly legal claims, D&O insurance is an essential tool for any startup looking to thrive in a competitive market.

Take the next step: Reach out to a trusted insurance advisor today to assess your startup’s risk profile and design a D&O insurance policy tailored to your company’s needs.

References

- Founder Shield. “The Need-to-Know of Startup D&O Insurance.”

- Heavybit. “The ABCs of Directors & Officers Insurance for Startups.”

- Insureon. “Why D&O Insurance is Crucial for Startups.”

- Doeren Mayhew Insurance Group. “Importance of D&O Insurance for Growing Technology Companies.”

- Risk Strategies. “5 Reasons Startups Need D&O Insurance.”