As a business owner, it’s important to protect yourself and your company from potential legal liabilities. One way to do this is through Directors and Officers (D&O) insurance.

D&O insurance is a type of liability insurance specifically designed to protect the individual directors and officers of a company from personal financial losses in the event of wrongful acts. This type of insurance is particularly important for small and medium-sized businesses, as they often lack the resources to absorb the costs of legal defense and settlements.

But what exactly does D&O insurance cover? It can protect against a wide range of potential liabilities, including:

- Misrepresentation or false statements in financial reports or other documents

- Breaches of fiduciary duty

- Discrimination and harassment claims

- SEC investigations and fines

It’s important to note that D&O insurance does not cover illegal or criminal actions, such as embezzlement or fraud. It is also important to work with a reputable insurance provider to ensure that your specific needs are met.

When it comes to purchasing D&O insurance, there are a few key factors to consider. First, it’s important to determine the appropriate level of coverage for your business. This will depend on factors such as the size of your company, the types of products or services you offer, and the potential for legal liabilities.

Another important consideration is the cost of D&O insurance. Premiums can vary widely depending on the level of coverage and the insurance provider. It’s important to shop around and compare rates from different providers to find the best deal.

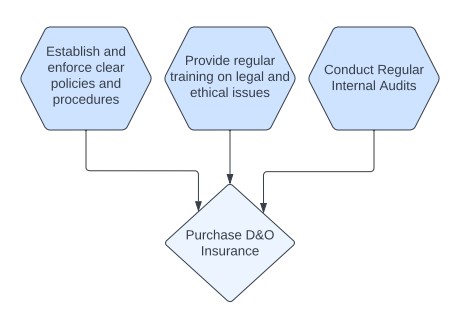

In addition to purchasing insurance, there are also steps that business owners can take to minimize their risk of legal liabilities. These include:

- Establishing and enforcing clear policies and procedures

- Providing regular training on legal and ethical issues

- Conducting regular internal audits to identify and address potential risks

Overall, D&O insurance is a valuable tool for protecting small and medium-sized businesses from potential legal liabilities. By working with a reputable insurance provider and taking steps to minimize risk, business owners can ensure that they are properly protected.

As a final note, it is important to work with a reputable and experienced insurance provider to ensure that you have the right coverage and that your specific needs are met.