Medical Spa Malpractice Insurance: Protecting Your Business and Your Patients

As a medical spa owner, you are responsible for ensuring the safety and well-being of your patients. One crucial aspect of this is obtaining adequate insurance coverage for your business. Medical spa malpractice insurance is specifically designed to protect your business from the financial repercussions of any mistakes or negligence that may occur during a treatment or procedure.

What is Medical Spa Malpractice Insurance?

Medical spa malpractice insurance, also known as professional liability insurance, is a type of insurance that covers your business in the event of a lawsuit resulting from a mistake or negligence made by you or your staff. It is designed to protect your business from the financial burden of defending against a lawsuit, as well as covering any damages or settlements that may be awarded to the plaintiff.

Why is Medical Spa Malpractice Insurance Important?

As the healthcare industry continues to evolve, the risks and liabilities faced by medical spa owners are also increasing. The rise of non-invasive cosmetic procedures, such as Botox and dermal fillers, has led to a greater need for specialized insurance coverage. Without adequate medical spa malpractice insurance, a single lawsuit could financially ruin your business.

What Does Medical Spa Malpractice Insurance Cover?

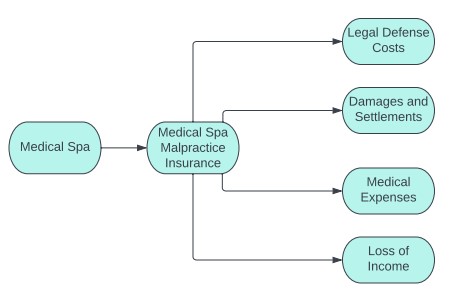

Medical spa malpractice insurance typically covers:

- Legal defense costs, including attorney fees and court costs

- Damages and settlements awarded to the plaintiff

- Any medical expenses incurred as a result of the mistake or negligence

- Loss of income due to a temporary closure of your business

It is important to note that coverage may vary depending on the specific policy and insurance provider. It is essential to thoroughly review and understand the coverage provided by your policy.

How to Choose the Right Medical Spa Malpractice Insurance Policy

When selecting a medical spa malpractice insurance policy, it is important to consider:

- The specific services offered at your medical spa

- The level of coverage needed for your business

- The reputation and financial stability of the insurance provider

- The cost of the policy and any potential discounts or bundle options

It is also recommended to consult with a professional insurance broker to ensure that you are getting the most comprehensive coverage for your specific business needs.

Conclusion

As a medical spa owner, it is crucial to protect your business and your patients by obtaining adequate medical spa malpractice insurance. This type of insurance is specifically designed to cover the financial repercussions of any mistakes or negligence that may occur during a treatment or procedure. By thoroughly reviewing and understanding the coverage provided by your policy, and consulting with a professional insurance broker, you can ensure that your business is fully protected.

This diagram shows the relationship between a medical spa, medical spa malpractice insurance, and the various types of coverage provided by the insurance, including legal defense costs, damages and settlements, medical expenses, and loss of income.