Protecting Your Business Dreams: A Comprehensive Guide to Franchise Insurance

Introduction:

Starting a franchise business can be a dream come true for many entrepreneurs. However, it also involves a significant investment of time, money and effort. Protecting that investment is crucial, and Franchise Insurance can play a key role in doing so. In this article, we’ll take a closer look at Franchise Insurance and explore what it is, why it’s important, and how to choose the right coverage.

What is Franchise Insurance?

Franchise Insurance is a type of insurance coverage specifically designed for franchise businesses. It provides protection against a variety of risks that are unique to the franchise model, such as those related to the franchisor-franchisee relationship, trademarks and other intellectual property, and financial loss.

Why is Franchise Insurance Important?

Franchise Insurance provides several benefits to franchise businesses, including:

- Protection against loss of income: In the event of a covered loss, Franchise Insurance can provide financial protection to help keep your business running and minimize the impact on your bottom line.

- Peace of mind: With Franchise Insurance in place, you can focus on running your business, secure in the knowledge that you’re protected against a range of risks.

- Compliance with franchisor requirements: Many franchisors require franchisees to carry Franchise Insurance as a condition of their agreement. Having the right coverage in place helps ensure that you’re in compliance with these requirements and can avoid penalties or termination of your franchise agreement.

- Protecting your investment: Franchise Insurance helps protect your business against financial loss and can help ensure that you’re able to recover and rebuild if disaster strikes.

What Does Franchise Insurance Cover?

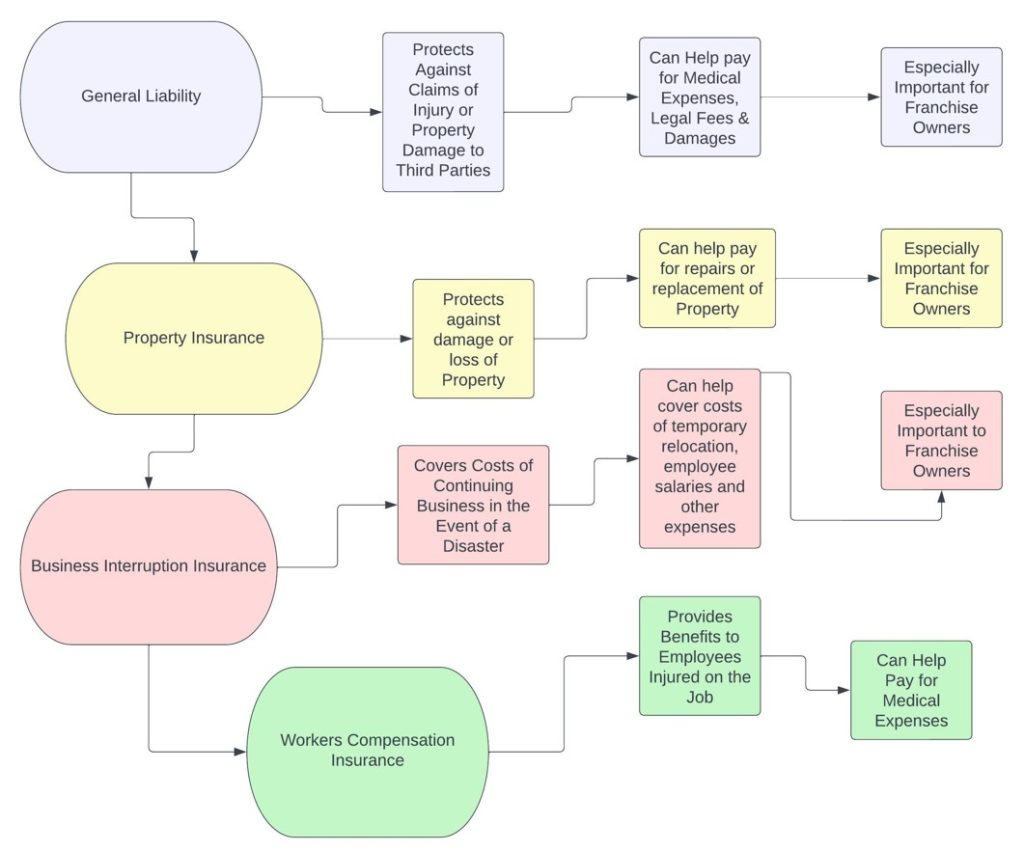

Franchise Insurance typically covers a wide range of risks, including:

- Property damage or loss: Coverage for damage to your franchise location and its contents, such as equipment, inventory and fixtures.

- Business interruption: Coverage for loss of income and expenses incurred in the event of a covered loss that temporarily stops or limits your ability to operate your franchise.

- Product liability: Coverage for claims arising from the sale or use of your products or services.

- Professional liability: Coverage for claims arising from mistakes or errors made in the course of your franchise business.

- Employment practices liability: Coverage for claims arising from employment practices, such as discrimination, wrongful termination, and harassment.

- Cyber liability: Coverage for losses related to data breaches, cyber attacks, and other cyber-related incidents.

- Trademark infringement: Coverage for claims arising from the unauthorized use of the franchisor’s trademarks, logos, and other intellectual property.

- Loss of key personnel: Coverage for loss of income and expenses incurred if a key employee leaves your franchise or is unable to perform their duties.

How to Choose the Right Franchise Insurance Coverage?

Choosing the right Franchise Insurance coverage can be a complex process, but here are some key considerations to keep in mind:

- Review your franchise agreement: Make sure you understand the insurance requirements outlined in your franchise agreement, and consult with your franchisor if you have any questions.

- Assess your specific risks: Consider the unique risks associated with your franchise business, and make sure you have coverage in place for these risks.

- Get multiple quotes: Get quotes from multiple insurance providers to compare coverage options and pricing.

- Work with an insurance broker: An insurance broker can help you navigate the insurance market and find coverage that meets your specific needs and budget.

Frequently Asked Questions about Franchise Insurance

Q: Is Franchise Insurance required by law?

A: No, Franchise Insurance is not required by law. However, many franchisors require franchisees to carry Franchise Insurance as a condition of their agreement.

Q: How much does Franchise Insurance cost?

A: The cost of Franchise Insurance varies depending on a variety of factors, including the size of your business, the coverage you need, and the level of risk associated with your franchise.

Q: Can I get Franchise Insurance from my franchisor?

A: Some franchisors offer insurance programs for their franchisees, but it’s important to review these programs carefully to make sure they meet your specific needs and provide adequate coverage.

Q: Can I get Franchise Insurance for my home-based franchise business?

A: Yes, you can get Franchise Insurance for a home-based franchise business. Some insurance providers offer coverage specifically for home-based franchises.

Conclusion:

Starting a franchise business can be a significant investment, and Franchise Insurance is a critical component of protecting that investment. By understanding the benefits and coverage options available, you can make an informed decision about the right Franchise Insurance coverage for your business. Don’t hesitate to reach out to an insurance broker for help navigating the insurance market and finding the right coverage for your franchise business.