The Ultimate Guide to Wildfire Coverage for Homeowners

At WHINS Insurance Agency, we understand that wildfires can cause devastating damage to your home and belongings. That’s why we’re committed to providing you with comprehensive wildfire coverage options that suit your needs. In this guide, we’ll provide you with detailed information on coverage limits, exclusions, and deductibles. We’ll also address common questions and concerns and provide authoritative sources to back up our claims.

Understanding Wildfire Coverage

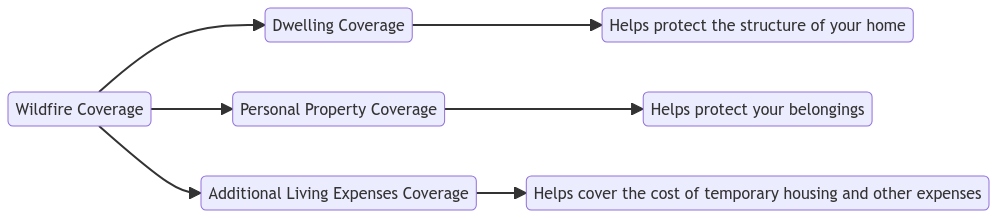

Wildfire coverage is designed to help protect your home and belongings in the event of a wildfire. This coverage typically includes three main types of coverage:

Dwelling Coverage: Dwelling coverage is designed to protect your home’s structure, including walls, roof, and foundation, in the event of a wildfire. This coverage can vary, depending on your insurance policy.

Coverage Limits: Common coverage limits can range from $500,000 to $5,000,000, depending on the cost to rebuild your home.

Deductibles: Deductibles can range from $1,000 to $10,000 to 1% of the dwelling limit, depending on your policy.

Personal Property Coverage: Personal property coverage is designed to protect your personal belongings, including furniture, electronics, and clothing, in the event of a wildfire. This coverage can vary, depending on your insurance policy.

Coverage Limits: Coverage limits can range from 50% to 70% of the dwelling limit, depending on the value of your personal property.

Deductibles: Deductibles typically follow the dwelling limit deductible, depending on your policy.

Additional Living Expenses Coverage: Additional living expenses coverage is designed to help cover the cost of temporary housing and other expenses if you’re unable to live in your home due to a wildfire.

Coverage Limits: Coverage limits can range from 20% to 50% of the dwelling limit, depending on your policy.

Deductibles: Deductibles typically follow the dwelling limit deductible, depending on your policy.

It’s important to note that coverage limits, exclusions, and deductibles can vary depending on your policy and the insurance provider you choose.

Addressing Different Wildfire Coverage Options

Different homeowners have different coverage needs. At WHINS Insurance Agency, we offer a range of wildfire coverage options to suit your specific needs. These options include:

High-Value Homes: If you own a high-value home, you may need additional coverage beyond standard dwelling coverage. We offer coverage options that can help protect your home and belongings from the unique risks that come with owning a high-value home.

Rental Properties: If you own a rental property, you may need additional coverage beyond standard dwelling coverage. We offer coverage options that can help protect your rental property and provide you with peace of mind.

Vacant Homes: If you own a vacant home, you may need additional coverage beyond standard dwelling coverage. We offer coverage options that can help protect your vacant home from risks such as vandalism and fire damage.

Addressing Common Questions and Concerns

We understand that you may have questions or concerns about wildfire coverage. Here are some common questions we receive from our customers:

What to Do If Your Home Is Damaged in a Wildfire? If your home is damaged in a wildfire, contact your insurance provider as soon as possible to file a claim. Your insurance provider will send an adjuster to assess the damage and provide you with next steps.

How to File a Claim: To file a claim, contact your insurance provider and provide them with the necessary information, such as the date of the wildfire and the extent of the damage. Your insurance provider will send an adjuster to assess the damage and provide you with next steps.

How to Reduce the Risk of Wildfires: There are several steps you can take to reduce the risk of wildfires. Clear vegetation around your home to create a defensible space Keep your roof in good condition and clear any debris that can easily catch fire Use fire-resistant building materials, such as metal roofing and non-combustible siding Install fire-resistant windows and doors. Ensure that your home has proper ventilation and fire suppression systems Have an evacuation plan in place in case of a wildfire.

How to Choose the Right Insurance Provider

Choosing the right insurance provider is important to ensure that you have the right coverage and support in the event of a wildfire. When choosing an insurance provider, consider the following factors:

Reputation: Look for an insurance provider with a strong reputation for customer service and claims handling.

Coverage Options: Ensure that the insurance provider offers coverage options that suit your specific needs.

Cost: Compare quotes from multiple insurance providers to ensure that you’re getting the best value for your coverage.

Customer Reviews: Look for customer reviews and ratings to gauge the experiences of other homeowners who have worked with the insurance provider.

At WHINS Insurance Agency, we believe in providing our client’s with accurate and trustworthy information from as many reliable sources as possible. Here are some links we think may be helpful to provide you with the information you need to make informed decisions about your wildfire coverage.

National Interagency Fire Center: The National Interagency Fire Center provides up-to-date information on wildfire activity and provides resources for homeowners on how to reduce the risk of wildfires.

Insurance Information Institute: The Insurance Information Institute is a nonprofit organization that provides objective information on insurance and risk management.

We’ve also included a coverage calculator to help you estimate your coverage needs and costs. You can find this tool on our website.

At WHINS Insurance Agency, we’re committed to providing you with comprehensive wildfire coverage options to protect your home and belongings. By understanding your coverage options, taking steps to reduce your risk, and choosing the right insurance provider, you can have peace of mind knowing that you’re prepared for the unexpected. Contact us today at 818-233-0833 to learn more about our wildfire coverage options and how we can help you protect what matters most.